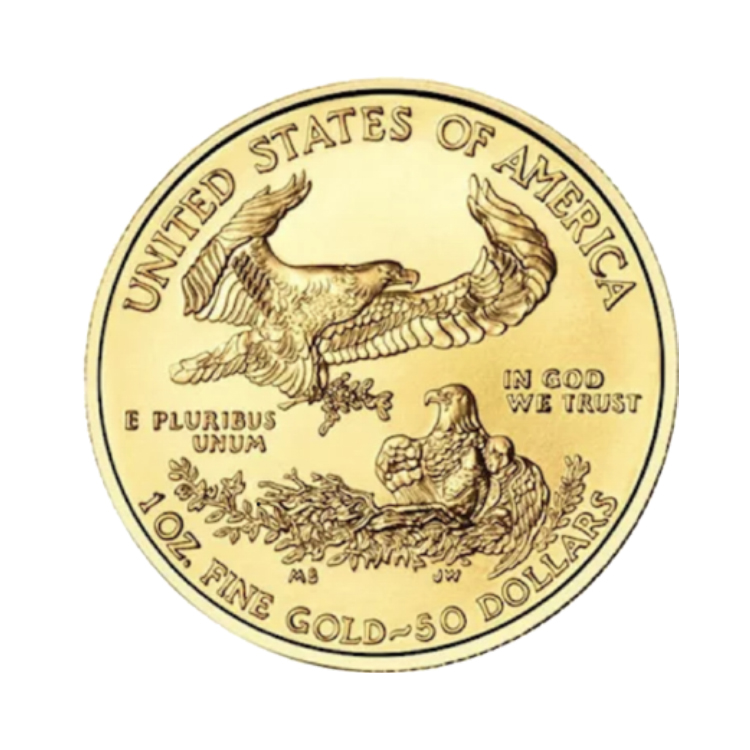

1 Oz Fine Gold American Eagle Coin

1 Ounce Pure Gold

Official United States Of America $50 Legal Tender

"American Eagle Gold Bullion Coin"

A Legal Tender Gold Coin.

Authorized by the Bullion Coin Act of 1985,

"American Eagle Gold Bullion Coins" are among the leading gold bullion investment coins, sought after, and having a well established reputation, they are currently bought and sold thorough the world.

Minted from gold mined in the United State.

American Eagle coins are imprinted with their actual "Gold Content" along with the designated "Legal Tender “ face value (denomination).

(1 oz $50.00)---- (1/2 oz $25.00)------(1/4 $10.00)---- (1/10 $5.00)

Gold Content

Fineness or purity is designated as 22karat gold

Twenty Two parts out of Twenty Four (22/24)

Ninety One Point Six Seven Percent (91.67%)

"22Karat is the well established "Gold Purity Standard" successfully relied upon by Individuals, Banks and Nations for more than Three Centuries (300+ years).

The gross weight of each 'American Eagle Gold Bullion Coin "is actually slightly more than that of its stated Fine Gold Content (F.G.C.)

The One troy ounce "American Eagle Gold Coin"

contains its full and designated quantity by weight of fine pure (24Karat) gold,

the puirity or fineness when described acording to the Karat standard can be understood by the following example

of the gross weight of 1.909 troy ounces.

twenty two (22) parts are Pure Gold

two (2) parts are an alloy (mixture) of copper and silver

is composed of commbined with the ballance being amounts of alloy. This creates durable coins that resist scratching and marring when being handled

Coin weighs

33.931 grams = 1.0909 troy oz Gross weight

Gold content

1 Troy Ounce =[31.1074 Grams]

%91.67 Gold

%3.00 Silver

%5.33 Copper

American Eagle’s current pricing at any time is influenced largley by the brokerage activity of "Bullion Markets" (London, Hong Kong, New Nork) "Spot Price" is derived from this trading activity

Brokerage involves trading of contracts known as "Futures" rather than actual gold . these contracts represent the written promise to release gold for delivery from a specific storage depository.

periodically when there was need compensate any shortage of promised gold to be available and the obligation to deliver to a contract holder, the banking or brokerage firm was forced to buy physical gold from the cash market regardless of the spot price premium.

from time top time premiums can seem high, when in reality they are merely forestalling or repressing a delayed but pending increase in the Spot Price.

Market price combined with a premium which is affected both by manufacturing costs as well as the currrent liquidity of the physical market or supply and demand of the investors and bankers as well as industrial users who must take actual posession of their gold.